Are you willing to get additional bonuses using your credit card? There are some credit cards that offer travel rewards and welcome bonuses. If you want to maximize your benefits, here is a list of the most suitable travel credit cards for you to choose from. Keep on reading and learn how to select the best credit card with welcome bonus offers.

How Travel Credit Cards Work

If you don’t have a travel rewards credit card, you should definitely get one. It accrues points and miles for every purchase you make on your card. Besides, there are welcome bonuses provided that you spend a particular sum of cash within a certain period after the card is opened.

Several redemption options are available after you get points and miles. You may obtain redemption options for statement credits, gift cards, and airline tickets. Redemption of points and miles for travel needs will bring you the highest value. If your current credit score isn’t perfect, there are the best companies to repair credit to help you qualify for the most affordable travel credit cards.

Points are earned on credit cards for every purchase made using your travel rewards card. Each crediting tool may have a different earning method. One credit card may offer higher rewards on dining purchases or travel; while another one will help you earn more perks on gas spending or groceries. Hotel and airline points can also be different. You should do your research to maximize redemption options and learn how you can earn your miles and points.

Should You Get a Travel Credit Card?

There are plenty of benefits to getting a travel credit card. Elite status, frequent discounts, lounge access, and free checked bags are among the top advantages of these cards. If you have these advantages, your travel experience will be more pleasant and comfortable. Furthermore, it will be cheaper and more affordable. For example, with a travel credit card, you might even have the chance to win a trip to Maldives or other luxurious destinations through special promotions or rewards programs, adding an exciting layer of anticipation and possibility to your travel plans. So, it pays to get a travel credit card to enjoy these rewards.

According to the US General Services Administration, the GSA SmartPay 3 program provides charge cards to US government agencies through master contracts that are negotiated with major banks. Nowadays, there are over 560 Federal agencies, Native American tribal governments, and other organizations taking part in the program, spending $30 Billion each year, through 100 million transactions on over three million cards.

Pros of Travel Rewards Credit Cards

- Lack of foreign transaction fees. You won’t need to pay extra for utilizing your credit card overseas as there are no foreign transaction fees.

- Elite benefits and perks. Complimentary breakfast and free luggage are among the top money-saving bonuses travel cards offer.

- Discounted or free travel. Apart from that, clients will get rewards for their spending. Such rewards can be used to lower travel expenses.

Cons of Travel Rewards Credit Cards

- Redemptions may be tough. Getting the most value for your miles and points can be complicated for certain reward programs.

- High annual fees. Those credit cards that have the highest premium benefits also come with higher annual charges.

- Limited-use bonuses. Redeeming the bonuses for more travel offers the best value in utilizing travel credit cards.

The Top Credit Cards with Welcome Bonus

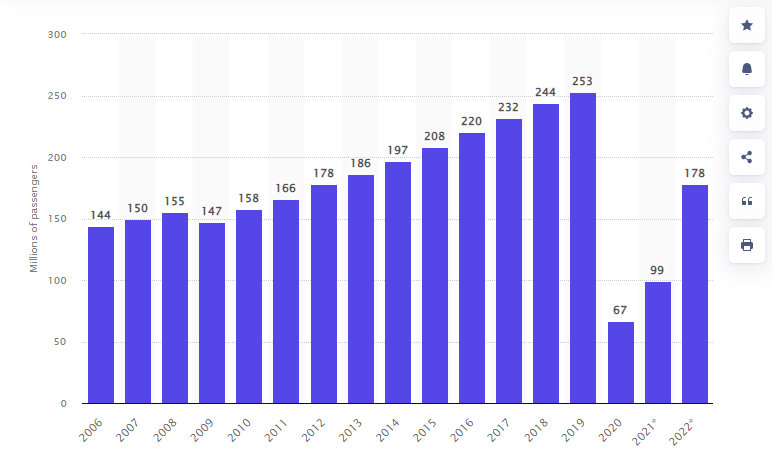

The recent Statista survey states that the total number of air passengers traveling to and from the USA was just 99 million in 2021 but the overall number of these passengers has grown steadily since 2006.

Here are the top-rated credit cards with a welcome bonus:

Marriott Bonvoy Brilliant American Express Card

After a client uses this card to make $5,000 in purchases, an additional $150,000 will be earned. The welcome bonus here is $1,050 while the annual fee is $650. Consumers who want to enjoy the benefits of Platinum elite status without having to spend too much cash should apply for this card. Keep in mind that it doesn’t occur too often, so you should consider this option as the welcome bonus is rather attractive.

Chase Sapphire Reserve

The welcome bonus here is from $1,200 to $1,520. If you spend $4,000 on various purchases within the first three months, you will be able to earn 60,000 bonus points. The annual fee is $550. This is an attractive offer for consumers but it doesn’t offer premium travel perks. Who can benefit from this travel credit card? Consumers who gather Chase Ultimate Rewards points and would like to have additional perks such as lounge access will benefit from using this card.

The Hilton Honors American Express Business Card

Once you spend $5,000 in purchases on your credit card within 3 months after its opening, you will earn 130,000 Hilton Honors Bonus Points. Besides, a Free Night Reward may be obtained after you spend $10,000 in purchases. The welcome bonus is $780 and the annual fee is $95. Should every person get this card? We advise business owners to get it if they are ready to put $15,000 on this card annually. The welcome offer will be available only after you spend $10,000.

Chase Freedom Unlimited

There is no annual fee with this card, and the welcome bonus is $300. Depending on the value of the other Chase Sapphire credit cards you may already have, this welcome bonus can be increased up to $570. Extra 1.5% cash back can be obtained on various purchases. Who will benefit from using this card? Those who want to get extra points for future travel won’t be able to enjoy them. On the other hand, the welcome bonus is reasonable.

The Bottom Line

There is a wide range of travel rewards credit cards today. Many of them offer a welcome bonus. You may redeem the rewards and points you get during your upcoming trips. Some cards have an annual fee while others don’t. Now you know how to select the most suitable credit card with travel rewards. Choose the best card tailored to your needs to boost your travel experience and bring more value.